Use of an Online Crowdfunding Platform for Unmet Financial Obligations in Cancer Care (PDF)

Background: Technologic innovations, expensive new therapies, and improved access to treatment have all contributed to the rising costs of oncologic care in the United States. The financial consequences for patients and their families are substantial. Patients with cancer often borrow money, avoid leisure activities, decrease food spending, sell possessions, go into debt, and/or declare bankruptcy, and they are at greater risk for disability or unemployment.3 These consequences are particularly great for patients who are underinsured or uninsured. Recently, online crowdfunding platforms are being increasingly used to supplement insurance and defray expenses, even for experimental and unproven treatments.4 We sought to characterize the use of crowdfunding to support oncology care needs, including any association between insurance status and other characteristics.

Methods: We identified the top 20 most prevalent cancers in the United States using data from the National Cancer Institute. Each cancer and US state was queried on the GoFundMe platform (www.gofundme.com) for 1000 individual searches (50 states × 20 top cancers = 1000 batches of searches). Using custom code for web scraping (software used to abstract and assemble website data for analysis), we identified 37 344 cancer campaigns on October 7, 2018. We used a randomizer to select 1035 campaigns, which we studied in detail. Narratives report details regarding a patient’s oncologic treatment and personal and financial life. We selected variables of interest using a roundtable discussion among all authors and 2 rounds of iterative testing to ensure consensus and reproducibility in extracting data. We determined insurance status from campaign author self-reporting and defined the underinsured as those who stated that they were underinsured or uninsured. The institutional review board at the University of California, San Francisco deemed this study exempt because all data were publicly available.

Interrater reliability for collected clinical and financial details exceeded κ > 0.81. Descriptive statistics, χ2, Fisher exact, and Kruskal-Wallis testing were used to compare characteristics by insurance status as well as associations between reported variables and donation totals using Stata 15 software (StataCorp). P values < .05 were considered statistically significant.

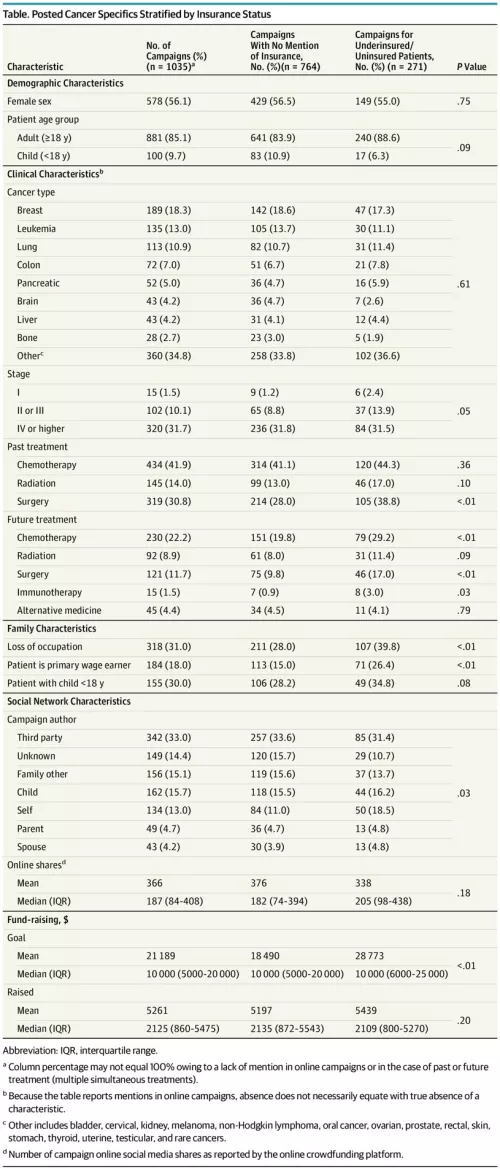

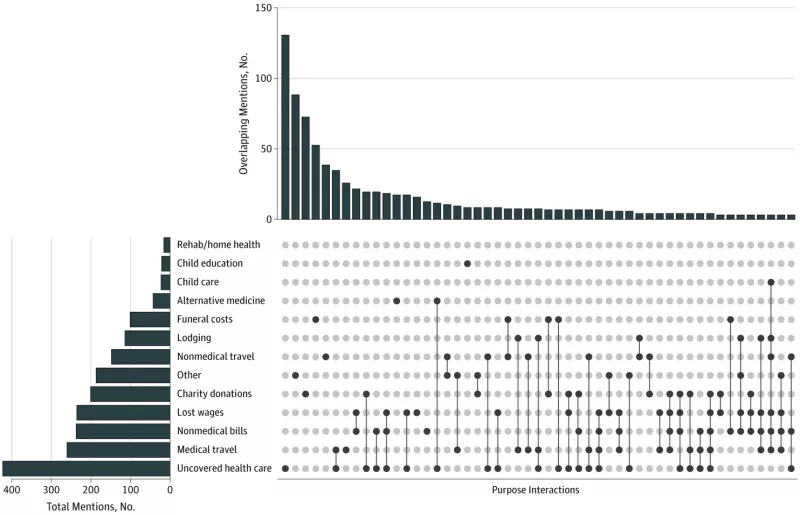

Results: Campaigns commonly described details regarding age, employment status, cancer type, treatment plans, and prognosis (Table). The median fund-raising goal and donations obtained were $10 000 (interquartile range [IQR], $5000-$20 000) and $2125 [IQR, $860-$5475], respectively. The most common campaign purposes were paying medical bills (n = 424 of 1035 [41.0%]), medical travel (n = 262 [25.3%]) and nonmedical bills (n = 240 [23.2%]), with 18 (1.7%) posters mentioning alternative treatments (Figure). Campaigns for underinsured patients requested $10 000 more on average than those that did not mention insurance. Campaigns with underinsured patients made up 26.2% (n = 271) of the population and were more likely to seek funds for unpaid medical bills compared with those that did not mention insurance (n = 178 of 271 [65.7%] vs n = 245 of 764 [32.1%], P < .01). Posters received approximately a quarter of their requested goal, independent of insurance status (Table). The underinsured, compared with those not mentioning insurance, reported unstable employment (n = 107 of 271 [39.8%] vs n = 214 of 764 [28.0%], P < .01) and were more likely to mention prior surgical treatment (n = 105 of 271 [38.8%] vs n = 214 of 764 [28.0%], P < .01). There were no significant differences in patient age, sex, type of cancer, or insurance status with regard to donation totals.

Figure: Stated Purpose for Requested Funds on an Online Crowdfunding Platform

Discussion: We have provided a detailed accounting of the characteristics of patients using a crowdfunding platform to support oncologic financial needs. The underinsured seek but do not receive higher donation amounts. Although the Affordable Care Act reduced the uninsured rate, cost containment measures have not been realized by all patients.5 In this cohort, patients reported multiple competing financial needs, but most pressing were unpaid medical bills, which may represent copays, out-of-pocket drug costs, or high deductibles. Medical travel costs also were highly cited; we speculate that regionalization of oncologic care may improve outcomes but increase the financial burden on patients.6 Limitations of the present study include generalizability to other patients, inability to determine the veracity of online claims, and determination of insurance status by narrative self-report. Nonetheless, these results suggest that the financial burden of health care requires increasing attention and advocacy.